There is nothing in the B-BBEE Codes of Good Practice (CoGP), or the B-BBEE Act, requiring businesses to obtain a B-BBEE certificate. It is not the 11th rule of business.

Government, however, has put together a package of laws and regulations which “force” companies to become B-BBEE compliant.

Examples of regulations which require B-BBEE compliance include:

- The Regulations to the Preferential Procurement Policy Framework Act set out the points allowed for B-BBEE compliance in tenders. It further allows State-Owned Entities and Government Departments to require certain levels of B-BBEE compliance when adjudicating tenders.

- The Department of Trade and Industry (dti) has required car manufacturers and suppliers in the motor industry to be B-BBEE compliant to be paid their AIS

The dti requires a level 4 certificate to allow other incentives as well as try raising funds from the IDC without a Level 4 certificate.

Businesses cannot score points on their B-BBEE scorecard for Skills Development if they do not have a Work Place Skills Plan, an Annual Training Report and a plan to develop scarce skills. It is accepted that all companies are Empowering Suppliers for B-BBEE purposes “until further notice” and no-one knows when such further notice will end. The requirements for Empowering Supplier included compliance with the Employment Equity Act, the Skills Development Act and the Skills Development Levies Act.

I want to move out of B-BBEE for this mailer and briefly address Employment Equity. As stated above Employment Equity is an important part of B-BBEE. This is topical as companies are being inspected by the Department of Labour and many are faced with significant penalties.

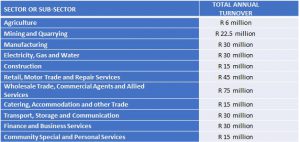

Most companies know the first of two requirements to become a designated employer. This requirement is that companies with more than 50 employees must file annual Employment Equity returns with the Department of Labour. They overlook the turnover thresholds in the Act. These thresholds are shown in the table below.

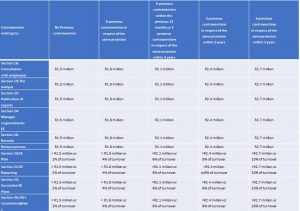

The Department of Labour is currently active in visiting companies to inspect their Employment Equity activities and ensure compliance with the Employment Equity Act. They are levying penalties based on the results of these reviews. The penalties are hefty.

In an article in Business Day on 14 September 2017 entitled “Businesses owe R22m for employment equity penalties” Theto Mahloana states: “The Department of Labour has claimed more than R23m from 360 employers prosecuted for not complying with the Employment Equity Act. However, only R1.3m has been paid so far, says the department’s director-general…”

I would hate to be a director of a company trying to explain such penalties to the board.

If you have any B-BBEE consulting needs, please contact either e-mail Charlene Skipp or call her on 083 780 7209. Alternatively you’re welcome to e-mail me, Richard, or contact me on 083 440 2130. Charlene and I can redirect queries on Employment Equity consulting.

Kind regards,

Richard Ryding

Global Business Solutions