It has been realised that there are various forms of capital, including financial, manufacture, intellectual, social and human capital, and that there is a need to ensure that these are properly addressed in King IV.

While a number of organisations have dragged their feet and are still getting to grips with the implications of the King III Report and the Companies Act, the Institute of Directors in Southern Africa (IoDSA) recently launched the King IV Report, which is open for public comment.

In this article, the writer attempts to summarise some of the important points arising out of the IoDSA’s recent launch of the King IV Report in Cape Town.

Why King IV?

The need for a change was prompted by local and international developments that occurred post-King III, some of which have led to the King Report being out of step with good practice.

Aspirations and areas of importance

It has been realised that there are various forms of capital, including financial, manufacture, intellectual, social and human capital, and that there is a need to ensure that these are properly addressed in King IV.

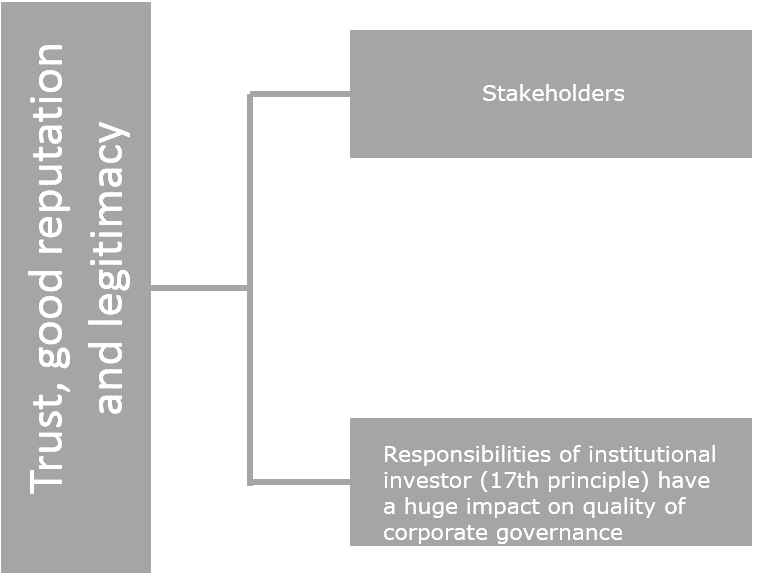

King IV takes a stakeholder-inclusive approach, which broadens the vision of corporate governance in South Africa.

Capitals that require attention

King IV highlights capitals that require attention:

- leadership

- organisation in society

- sustainable development

- shareholder inclusivity

- integrated reporting.

King IV echoes King III and is not a new report. What remains relevant in King III is incorporated in King IV.

The aspirations in King IV are to move from:

- box ticking (with no appreciation of the value the Report’s recommendations add) to mindful application

- grudge compliance to an appreciation of the value added

- listed companies to all organisations (for example, public investment corporations and civil society). This is because corporate governance is a small system within a bigger system. Corporate governance in one entity affects the corporate governance of the other entity (for example, an SME in the Nike supply chain).

Benefits of sound corporate governance

Sound corporate governance leads to healthy organisations and is about ethical and effective leadership.

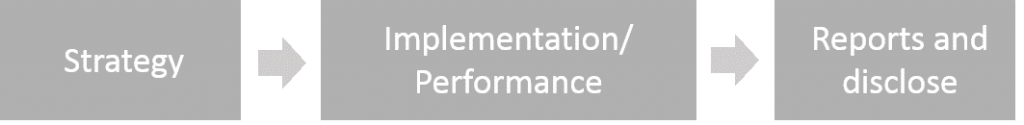

Corporate governance involves:

- strategy and direction

- approving policy for putting strategy into effect

- oversight and implementation

- disclosure, by being accountable and by reporting.

King IV allows for situations where a specific situation is not dealt with. This allowance then gives the organisation the ability to not conclude a tick box exercise, but to have the King IV find practical application to the organisation’s practical circumstances.

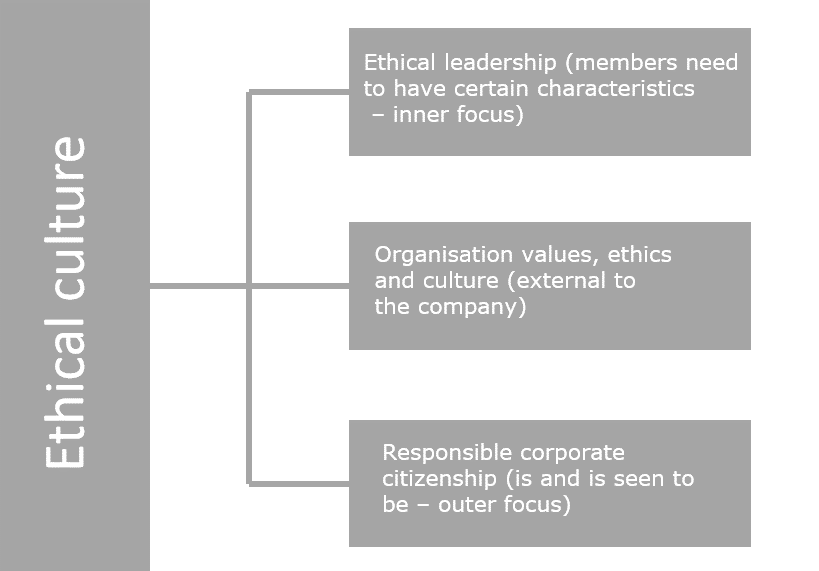

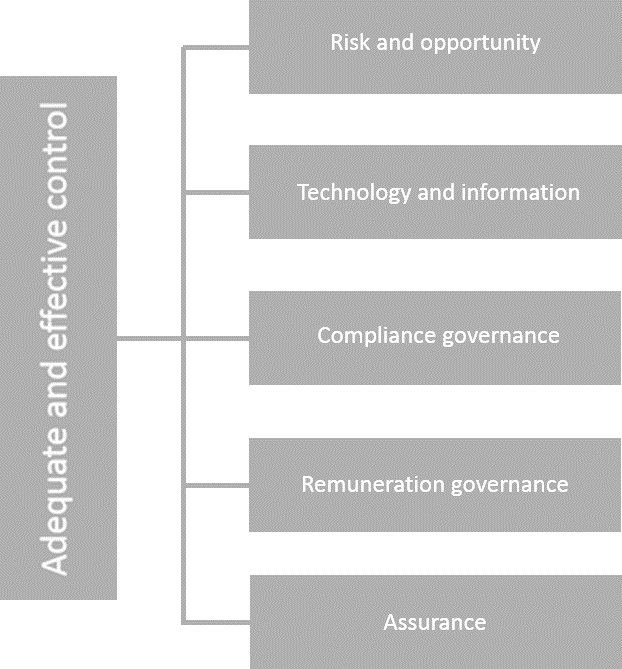

Sound corporate governance has the following critical governance outcomes:

- ethical culture

- performance across the triple context and value creation

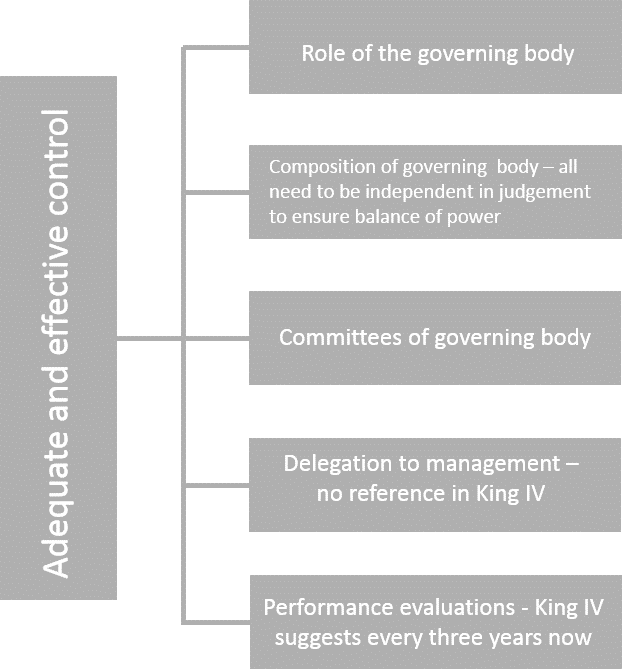

- effective and adequate control

- trust, good reputation and legitimacy.

King IV sets out normative statements of what organisations want to achieve. Once this is done, practices are set in place. This takes the process up a level and is fundamentally different from King III.

What sets King IV apart?

King IV:

- is outcomes- and norms-driven

- caters for all organisations

- has been reduced from 75 principles to 16 + 1

- is less prescriptive but more transparent

- allows organisations to ensure the practical application of the report in a form applicable to business.

Supplements will be issued shortly and will deal with how to adapt practices in specific organisations.

They will be between six and eight pages long. By introducing these supplements, King IV provides for proportionality, in other words, how to scale the practices to the size of the organisation.

Apply AND explain

The Commission’s view is that there is no explanation for non-adherence to King IV because the normative statements can be applied to everyone, whereas the practices fall within the discretion of the company. A controversial point of discussion and comment is the involvement of the Social and Ethics Committee on remuneration.

The King IV chapters captured

Chapter 1: Leadership, ethics and corporate citizenship

Chapter 1 from King III has been carried over to King IV.

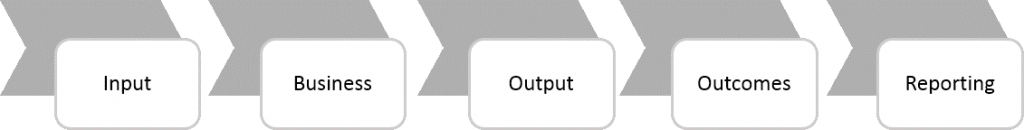

Chapter 2: Performance and reporting

Note that this chapter is very different from King III because not only does it focus on control but performance. Performance must enhance each of the capitals.

The governing body should head the value creation process.

Chapter 3: Governing structures and delegation

Chapter 4: Governance functional areas

This chapter deals with a number of issues linking King III succinctly.

King IV still focuses on the combined assurance model, but unpacks it a bit more. The Commission now refers to five lines of assurance and moves away from the three lines of defence.

| King III | King IV |

| Own and manage, for example management controls | Own and manage |

| Oversees risk, for example, risk management, financial controller and compliance | Oversees risk |

| Independent assurance, for example internal audit and external audit | Internal objective assurance External assurance providers Governing body |

Remuneration governance

One of the most fundamental changes is regarding the governance of remuneration.

The Commission has attempted to keep matters at a principal level and as such it appears less detailed, however, the change is no less fundamental.

The Remuneration Committee should oversee that executive remuneration is responsible in terms of overall employee remuneration (in other words, remuneration must ‘talk’ to the wage gap).

There are a number of comments suggesting that the Social and Ethics Committee be given a role in remuneration decision making. A comment received was that the Social and Ethics Committee does not have the skill set to deal with this and that it does not make sense to have both the Remuneration Committee and the Social and Ethics Committee involved.

A further important change is that executive remuneration should take into account performance across the triple context or capitals (and not only shareholder value).

Remuneration also controversially requires disclosure. The following should be disclosed:

- the context and factors taken into account in arriving at the remuneration

- the remuneration policy of the company

- the actual numbers.

It is important to note that the role of the Social and Ethics Committee in general does not change. The Remuneration Committee’s role is to monitor and report.

With regard to remuneration, it has been suggested in some of the comments to date that the Social and Ethics Committee looks only at whether the executive pay versus other employees’ pay is proportionate. The Social and Ethics Committee then provides a view or input, but does not make a decision.

Chapter 5: Stakeholder relationships

As critically important as good stakeholder relationships are, they also pose a large risk to organisations. In this particular part of King IV, there is a view expressed in the submissions received to date that it is believed that the use of social media and the interactions with stakeholders thereon could prove particularly relevant and challenging.

Conclusion: the process to follow

King IV is currently open for comment and it is expected that it will be launched on 1 November 2016. After launching, there will be a transition period, as it was with King III.

It will be good to see whether the aim of practicality and moving to apply and explain will lead to the achievement of the Commission’s objectives.

Kind Regards

Grant

This article first appeared in the Corporate Report – Author Grant Wilkinson. Subsequent to the article appearing in the Corporate Report, the King Code was launched with great success by the IoDSA at a glittering event in Sandton.

All the diagrams have been sourced and adapted from the IoDSA launch of the King IV report. This article was originally published on the University of Stellenbosch Business School’s website.

See http://www.usb-ed.com/WatchReadListen/Pages/King-IV-A-summary-of-what’s-to-come.aspx.