All the best for 2018. I hope it is prosperous year for you.

B-BBEE is an increasingly relevant topic in given the current state of the South African economy. In a changing environment, it is important that businesses ensure their focus is correct in order to ensure the best return on their investment in this space. The last 15 years have seen the development of organisations aimed at supporting businesses with their compliance, and associated development. The B-BBEE verification and consulting industry have emerged, and companies are partnering with consultants to get their BEE affairs in order.

What investment do companies need to make in BEE?

- Compliance: (Verification and preparation for the verification). BEE is an intricate space and needs regular, if not full-time, attention. Many larger companies are hiring Transformation Managers and their portfolio includes BEE, Employment Equity and other transformation matters. The old days of only considering BEE before the verification have ended, to do so will result in a bad certificate.

- Ensuring a good BEE level: This means ensuring that your investments in Enterprise Development, Supplier Development, Socio-Economic Development, training your staff and procuring from the appropriate companies, bear fruit. Items such as Skills Development, Procurement and Socio-Economic Development are items that most companies do in their usual course of business. Development of black business, which will be scored under Enterprise and Supplier Development is not a normal business activity, but need to be considered for BEE purposes. We must find ways to make such activities business relevant.

Remember a poor, or low BEE Level may result in the loss of business to competitors with better scorecards. Companies must also consider the loss of funding and incentives from Government. We have seen this specifically in the motor industry.

Ownership

Ownership is a priority element. If companies do not score at least 40% of the Net Value (3.20 points on the Codes of Good Practice scorecard), they will be automatically discounted a level. If companies are pressured by Government or customers to maximise their levels, black ownership must be considered.Many companies considering black ownership put vendor financing deals into place where the seller receives payment from dividends paid to the black purchaser. If dividends are not paid the debt cannot be serviced and this causes Net Value issues, as debt is a consideration when calculating Net Value.

Skills Development

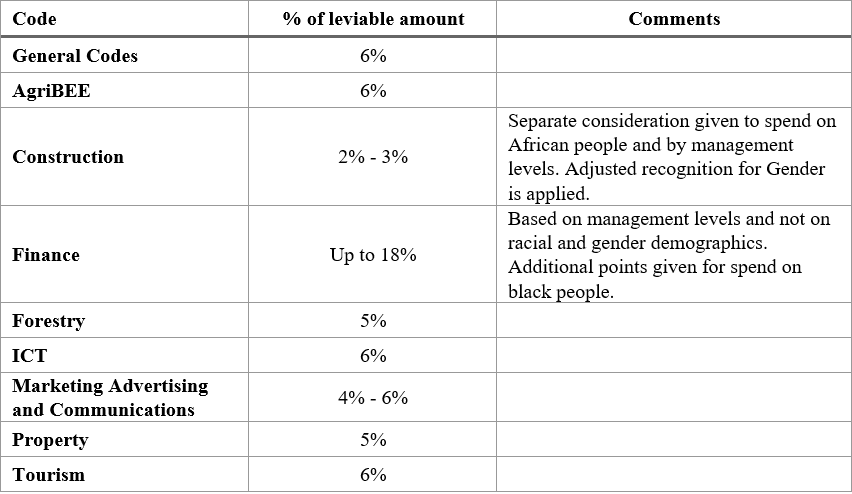

Skills is also a priority element leading to the discounting of a level if companies do not score 40% of the total skills development points (excluding bonus points). If the company has been discounted for ownership, they will not lose another level. The target for companies under the General Codes is 6% of leviable amount (which should be substantially the same as payroll or reconcilable to payroll).

Skills Development now emphasises formal qualifications. Other training is limited to 15% of the total skills development claim. Companies may send their staff on courses and only be able to recognise 15% of the cost of training.

The following table summarises the percentage of the leviable amount to be spent on training for the General and Sector Codes. Note that spend must also be made in terms of the correct racial and gender demographics to maximise impact.

Enterprise Development

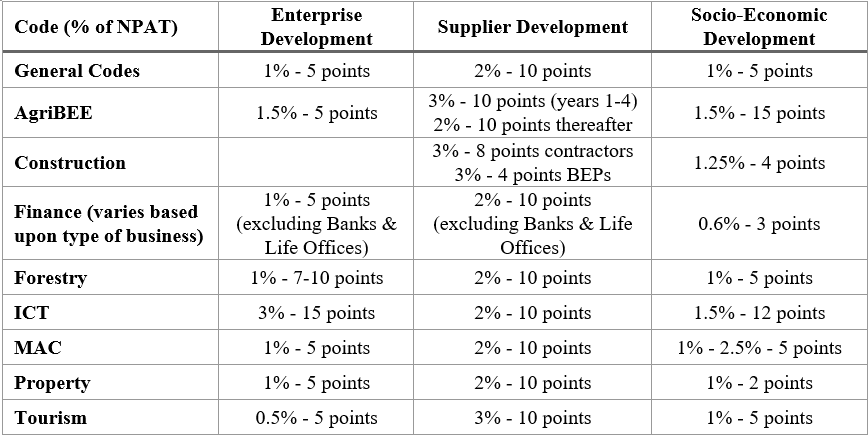

Enterprise Development is another priority element. This is money spent to develop customers or potential suppliers which are 51% black owned or 51% black women owned with turnover less than R50 million. This is based on a percentage of net profit after tax.

Contributions range from loans, grants, other forms of financial assistance, training and discounts to relaxed payment terms and staff time. Percentages are shown below.

Supplier Development

This is the final priority element and is money spent to develop suppliers which are 51% black owned or 51% black women owned with a turnover less than R50 million. It is based on a percentage of net profit after tax. Contributions are the same as Enterprise Development. Percentages are shown below.

Socio-Economic Development

This is corporate social investment. Many companies do this in their normal course of business as they see it as part of being a good corporate citizen.

Other sector codes may have sector-specific elements such as the MAC code which includes Responsible Social Marketing and Communications at 1% of NPAT for five points. Other sector codes may have sector-specific elements such as the MAC code which includes Responsible Social Marketing and Communications at 1% of NPAT for five points.

In summary:

- B-BBEE is an expensive exercise, especially in today’s poor economy. Some clients have calculated that they have to spend more than 14% of their net profit after tax to score well on their B-BBEE scorecard. Companies cannot afford to spend such amounts and not have the desired BEE results.

- It is very important to record all expenditure completely, accurately and timeously.

- It is also important to ensure that all Skills Development, Enterprise Development and Socio-Economic development expenditure are well-planned and accurately recorded.

- B-BBEE is an important area of financial (and altruistic) investment for businesses and we need to ensure the impact is maximised.

Our consultants have over 25 years of business experience and are well positioned to assist you with strategy including the identification and recording of your investments in this area.

If you have any B-BBEE consulting needs, please contact either Charlene Skipp on [email protected] (083 780 7209) or me on [email protected] (083 440 2130). Charlene and I can redirect queries on for Employment Equity consulting.

Kind regards,

Richard Ryding

Global Business Solutions