Employee Dismissed for Illegal Money-Lending Scheme Loses Court Battle

- Jonathan Goldberg

- Jul 30, 2025

- 3 min read

In the matter of KAWENG V SOUTH AFRICAN NATIONAL BIODIVERSITY INSTITUTE AND OTHERS (JR221/22) [2024] ZALCJHB 401 (18 OCTOBER 2024) an employee and shop steward at the employer was dismissed after being implicated in an illegal money-lending scheme. He challenged the dismissal, seeking a review of an arbitration award that upheld the employer’s decision.

The case began with a whistleblower report on 11 June 2019, alleging a loan shark operation at the employer. While the report did not name the employee, the employer hired forensic investigators, Mazars, to investigate. Their report, completed on 17 September 2019, implicated a senior artisan in running a money-lending scheme with interest rates up to 50%, but it did not mention the employee by name.

Despite this, the employee was charged with participating in the scheme in 2017, violating the employer’s disciplinary policies. He was dismissed on 17 August 2021. During arbitration, the employer relied on the whistleblower report, the forensic investigation, and statements made by another employee. However, the director testifying for the employer had no direct knowledge of the employee’s actions.

The employee argued that he had only participated in a stokvel, which is legal under section 8(2)(c) of the National Credit Act (NCA). He admitted money had been lent and interest charged but insisted he left once these practices began.

The Commissioner found the dismissal fair, rejecting the employee’s claim that he had only participated in a stokvel. She noted that traditional stokvels involve savings and investment, not lending money to non-members or charging interest. The employee admitted under cross-examination to lending money and charging interest.

Although there was no direct evidence of reputational harm, the scheme disrupted the workplace, with borrowers facing threats over unpaid debts. The Commissioner ruled that the employee’s continued involvement, despite knowing it was illegal, justified dismissal.

The employee sought a review of the arbitration award, arguing that the Commissioner relied on hearsay evidence and mischaracterised the stokvel. The Court dismissed these claims, finding that the Commissioner based her conclusions on the employee’s own admissions. The employee had acknowledged lending money and charging interest in 2017, which was sufficient evidence.

The Court also rejected his argument that his actions were protected under the NCA. It found the stokvel had evolved into a money-lending scheme involving third-party borrowers, including employees charged interest. This fell outside the legal stokvel exemption, which applies only to transactions between members under formal rules.

Furthermore, the Court noted the employee knew the scheme required registration with the National Credit Regulator (NCR) and that its unregistered status made it illegal. Despite this, he continued to participate and benefit from it.

Ultimately, the Court ruled that, even if the scheme had not violated the NCA, the dismissal was reasonable. Charging excessive interest rates and disrupting workplace operations constituted serious misconduct. Though dismissal was harsh, it was within the range of acceptable responses.

The Court dismissed the review application. No costs order was made.

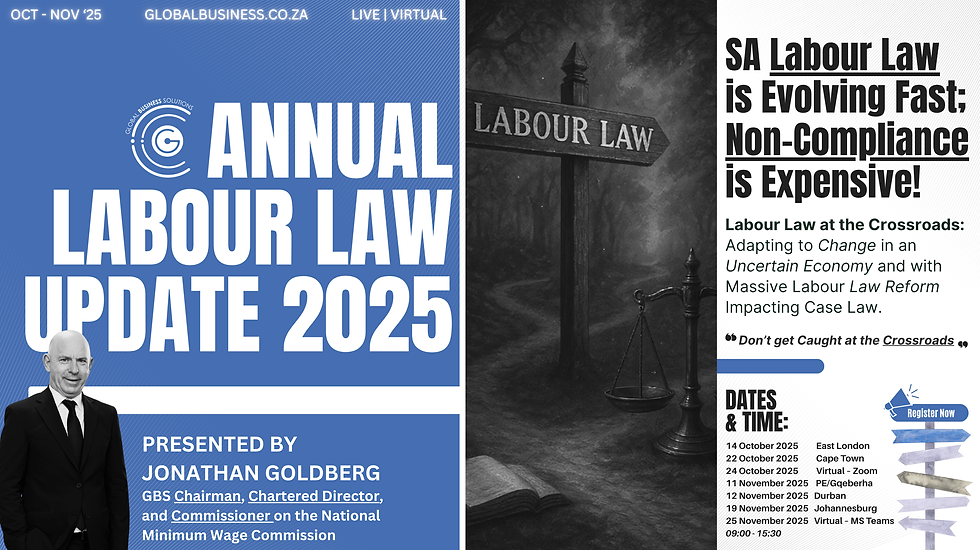

Join us at the Annual Labour Law Update. This year's theme is Labour Law at the Crossroads: Adapting to Change in an Uncertain Economy and with Massive Labour Law Reform Impacting Case Law. What you'll gain:

Master the Digital Transformation of Labour Law in 2025

200+ Labour Law Cases Unpacked by Jonathan Goldberg

Critical Updates on Upcoming Legislation & NEDLAC Amendments

Navigate Workplace Challenges from the Digital Era to Discrimination Laws

View our upcoming events: Upcoming Events, like EFFECTIVE ARBITRATION: Practical Tools for Labour Disputes, or Effective Strike Management.

*All workshops are offered as customised in-house training that can be presented virtually or on-site.

"Global Business Solutions (GBS) - Your Partner in Strategic HR Compliance"

Comments